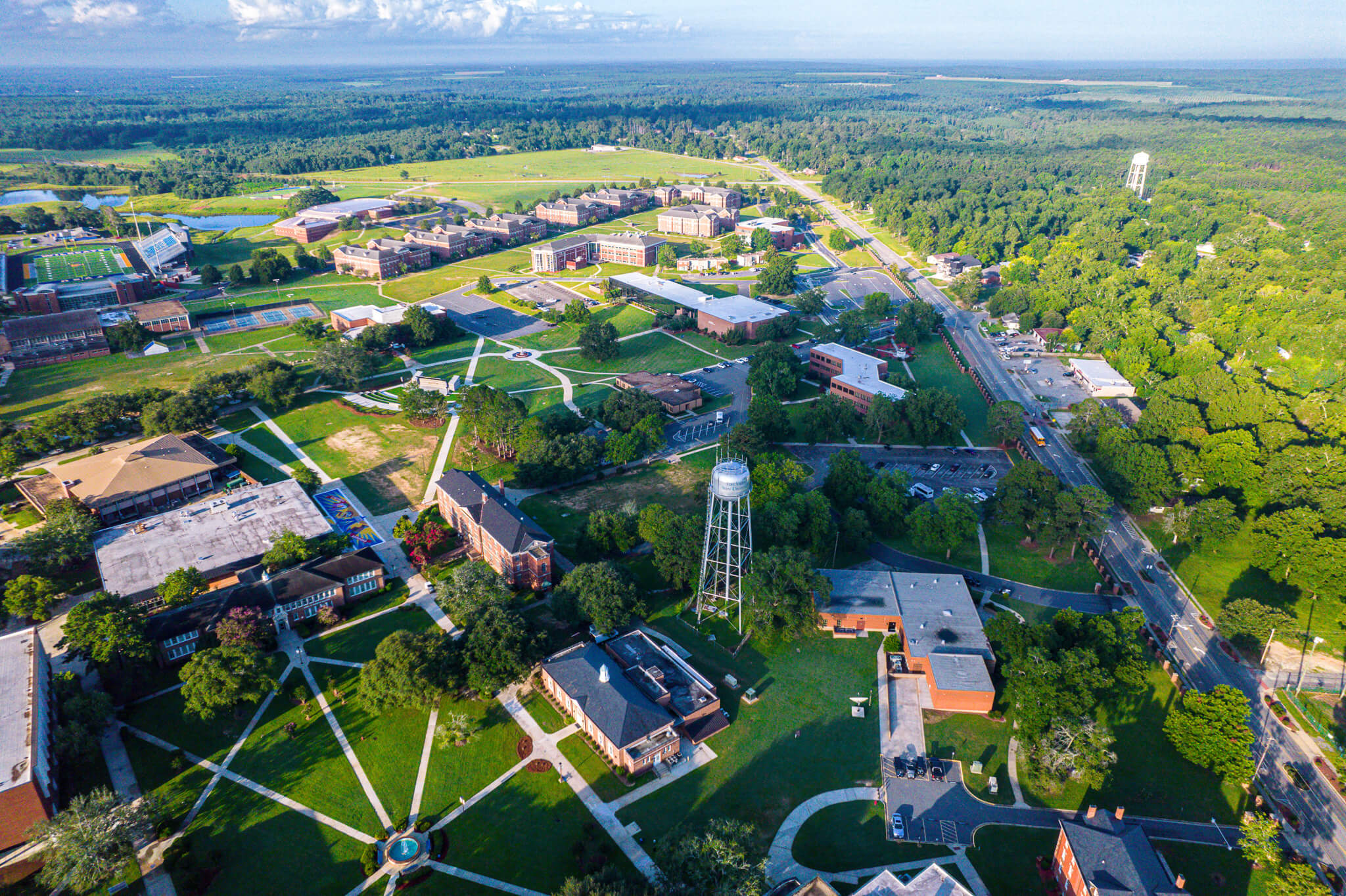

Empower

Your Passion

At Fort Valley State University, we empower students to push the boundaries of what is possible. With our dedicated faculty, state-of-the-art facilities, and innovated programs, we offer our students an unparalleled opportunity to explore their interests and prepare for a fulfilling career.

This Week

@ FVSU

There's always something happening in Wildcat Nation. View our campus calendar to stay up-to-date with the latest events on and off campus.

Empowering

Educational Dreams

Financial Aid

Higher education is a profound financial commitment. Fort Valley State University is committed to making education accessible to students from all backgrounds.

Scholarships

To support our commitment to accessible and affordable education, Fort Valley State University offers a variety of competition and performance based scholarships.

Work Study

Fort Valley State University offers Federal Work-Study to help students cover a portion of their educational expenses while working on campus.

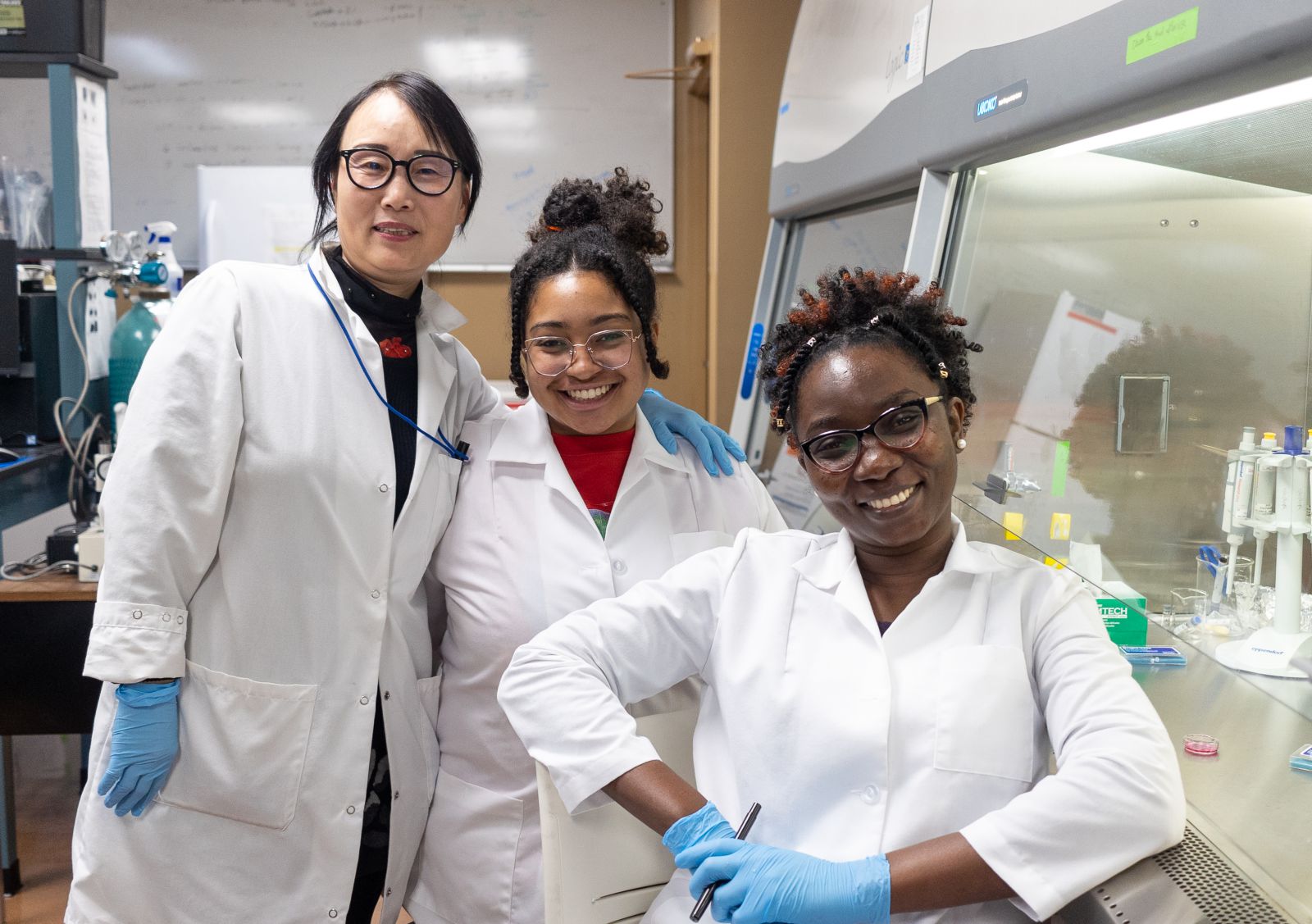

Excellence Empowers

Success

FVSU leverages its near 128-year tradition of excellence and uniqueness in academic and co-curricular programming to educate students and provide opportunities to engage directly in world-changing research with internationally recognized faculty members tackling complex global challenges.

A Message From

Paul Jones, Ph.D.

10th President

Founded in 1895, Fort Valley State University has a storied history, peopled by graduates that have gone on to impact the world of politics, industry, science and the arts. We provide our students an educational environment where opportunities in experiential learning and hands-on research abound. I invite you to join FVSU and EMPOWER the POSSIBLE.

.jpg)

Recent

News

Fort Valley State University faculty, staff, students and alumni are making headlines! Explore our pressroom and read the latest news from our University community.

Home

Fort Valley State University Celebrates Success of the 2025 REP4 Southeast Design Thinking Summer Summit

FVSU proudly launched the 2025 REP4 Southeast Design Thinking Summer Summit, welcoming a vibrant cohort of nearly 40 students ready to explore innovative solutions to real-world challenges.

.png)

Home

Field Trip to Portal Innovations Showcases Integration and Application of Biotechnology in Real-World Settings

STEM Leaders and Students visit Portal Innovations in Atlanta.

.jpg)

Home

Field Trips to Biotechnology and Genomic Research Boost Students’ Lifelong Success

STEM Leaders and Students visit UGA's College of Agricultural and Environmental Sciences Facilities.

.png)

Home

Fort Valley State University Celebrates its Inaugural Cohort of Nurses

History will be made this week at FVSU as the first cohort of students in the university's Bachelor of Science in Nursing (BSN) program graduate and receive their nursing pins.

.jpg)